travel nursing tax home audit

At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. It is what you do at the end of your shift which determines if the assignment is far enough to qualify as a Travel Assignment.

How Often Do Travel Nurses Get Audited Tns

Some claim they have found a way around the taxable aspect without needi.

. If you return home at the end of your shift you cannot deduct miles andor meals as tax free per diem stipends. The travel nurse agency may be audited which means the IRS will look into all of its employees. However there are two situations in which renting a home is not fatal to the tax residence.

I assume that those who believe they dont have a tax-home are harboring this belief because. When situating your Tax Home Consider that some States have no Income Tax at all. Establishing a Tax Home.

Tax homes tax-free stipends hourly wages bonuses benefits housing and per diem reimbursement are all factors to consider when understanding your travel nursing pay and taxes. You will not have duplicated expenses thus you should be taxed on your stipends. Make sure you qualify for all non-taxed per diems.

Documents that can help prove the validity of a tax home are. Pearson Level 2 Endpoint Assessment for Healthcare 3 from vdocumentssite. So as a Travel Nurse it can get kind of confusing where yours is right.

For instance if your mortgage is 10000 a month but your overall income with your base pay as a travel nurse is only 20000 annually the IRS may be puzzled as to how youre actually affording your lifestyle. You may have a lot of deductions on your tax return. The IRS defines a tax home as the entire city or general area where your main place of business or work is located regardless of where you maintain your family home For most people their tax home and their permanent home are the same place but travelers fall into a small category of people like professional athletes and truck drivers who earn money outside.

Distance is not the only qualifier for Travel Nursing stipends. The IRS may want to double-check to make sure youre being honest on your tax return. His 1 actionable tip to travel nurses to make tax time.

As a travel nurse you may be more at risk for an audit if youre displaying high expenses and low income. One story says that an hourly wage of less than 20 for a registered nurse sets off a red flag with the IRS. Some audits are completely random so there is really no way to predict or avoid them.

Or worry about an IRS audit. However it might be one of the most important. A tax home is different than a.

When I was in college I bought a three-bedroom townhome and rented out the other two bedrooms to friends. The other story says there is no problem with taxable wages between 15-20 per hour. Since I was still using the residence as my home if I had decided to travel the dwelling.

Is establishing and maintaining a tax home. You wont be eligible for tax free housing per diems and travel but you wont have to maintain a home either. It refers to the general geographic location where you primarily work.

For an obscure example. Another reason you may face a travel nurse IRS audit is if the IRS is auditing your entire agency. From tax homes to tax audits heres how travel nursing taxes work and how you can make sure you reap the greatest rewards.

A bit technical and unlikely that a first line auditor would catch it in my belief anyway. Travel to and from your tax home counts towards time worked. I find that crunching the numbers works better for a well set up tax home for example rent or buy a home and get a roommate to pay for.

Not all audits are brought on by red flags. Your taxable income may be low enough for the IRS to take notice. The following nine tips can make filing your travel nurse taxes easier save you money and help you avoid future tax liability.

Everyone has to have somewhere to live and something to eat but since that financial burden may be double for traveling workers the cost is alleviated through. Thus working four consecutive 3 month assignments is actually greater than a year. Travel Nursing Tax Home Audit.

How to Prepare for a Travel Nurse IRS Audit. A travel nurse explained he was hearing two different stories regarding taxable wages. A tax home is different than a home home.

Deciphering the travel nursing pay structure can be complicated. The IRS requires travel nurses to have a tax home else they pay taxes on all of their stipends and reimbursements. Maintaining a tax home has been a hot topic among Travel Nurses for quite some time.

There is nothing wrong with being itinerant without a home either. This is not always the same as your permanent residence. Alaska No Income or Sales Tax.

Travel nurses must have a tax home. You can review this four part series 1 2 3 4 for detailed information on how to accomplish this. Mar 03 2021.

2021 has been a unique year for travel nurses and some pay packages were different. The second biggest challenge for travel nurses when it comes to taxes is establishing and maintaining a tax home. You can review this four part series 1 2 3 4 for detailed information on how to accomplish this.

The final reason you may be on the radar of the IRS is pretty universal. Dont File Your Taxes Until You Read This. So say when you start travel nursing you live in Arlington VA which is in the.

A partial rental and a vacation rental. The 50-mile radius is a policy set by the. First travel nurses should consider the possibility of establishing and maintaining a tax-home so that they can qualify to receive the tax-free stipends.

There are always technicalities on top of sound bites. In fact he received pay quotes from large companies with. A typical tax home for a typical person is easy.

Because of the blended rate that many travel nurses earn which combines taxable and non. A tax home is NOT your place of residence. But there are some pretty standard guidelines out there for travel nurses that we can follow to stay safer in case of an audit.

In addition to patient care skills a good bedside manner and medical knowledge travel nurses also need to be well-versed in financial matters if they want to maximize their earnings and survive tax season.

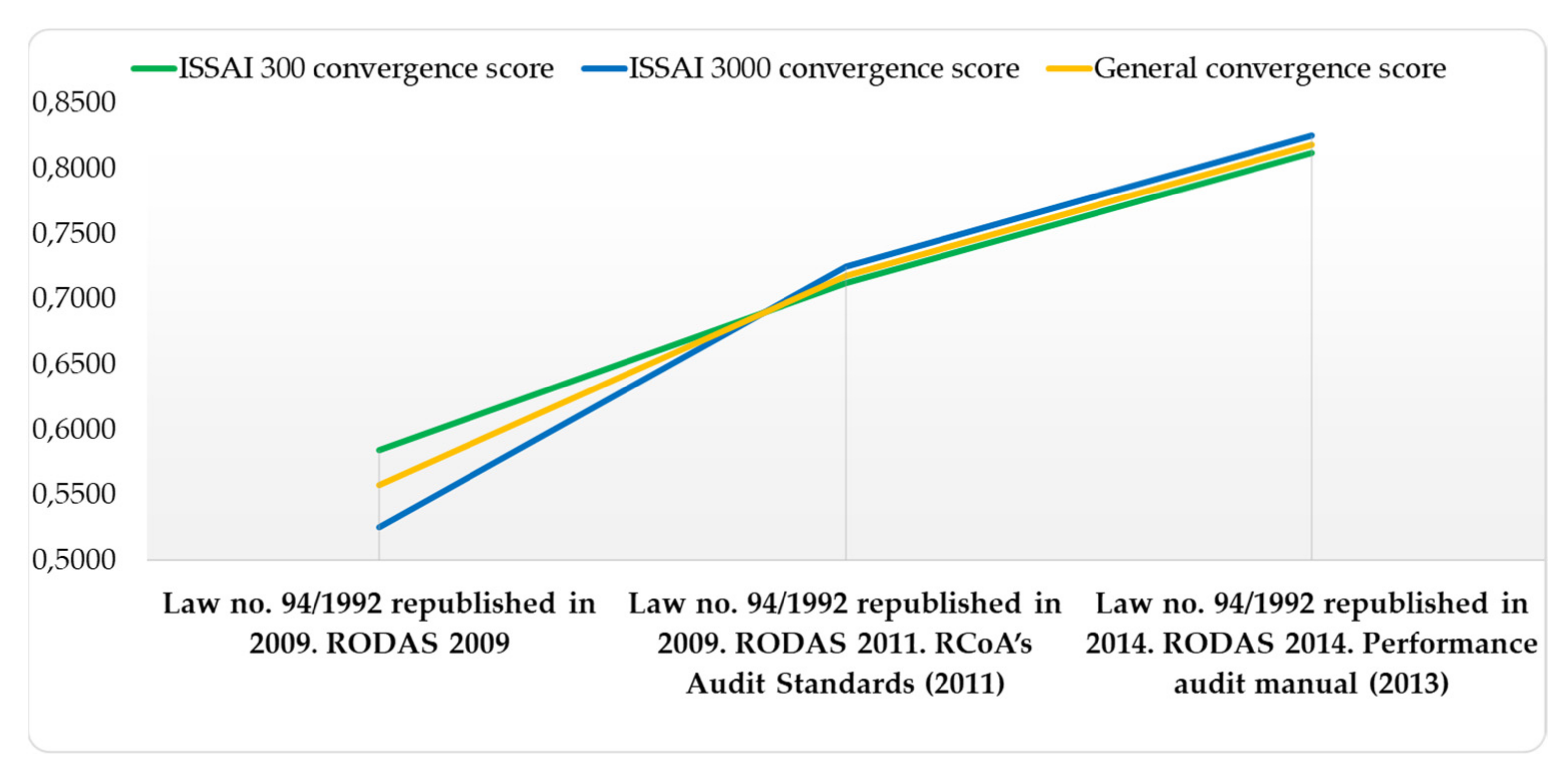

Sustainability Free Full Text Harmonisation And Emergence Concerning The Performance Audit Of The Eu Member States Public Sector Romania S Case Html

How Often Do Travel Nurses Get Audited Tns

Healthcare Travel Taxes For Pas Nps And Allied Workers 6 Things To Know

Travel Nurse Irs Audit Why They Occur And What To Expect

Concept Meaning Of Turnover In Tax Audit

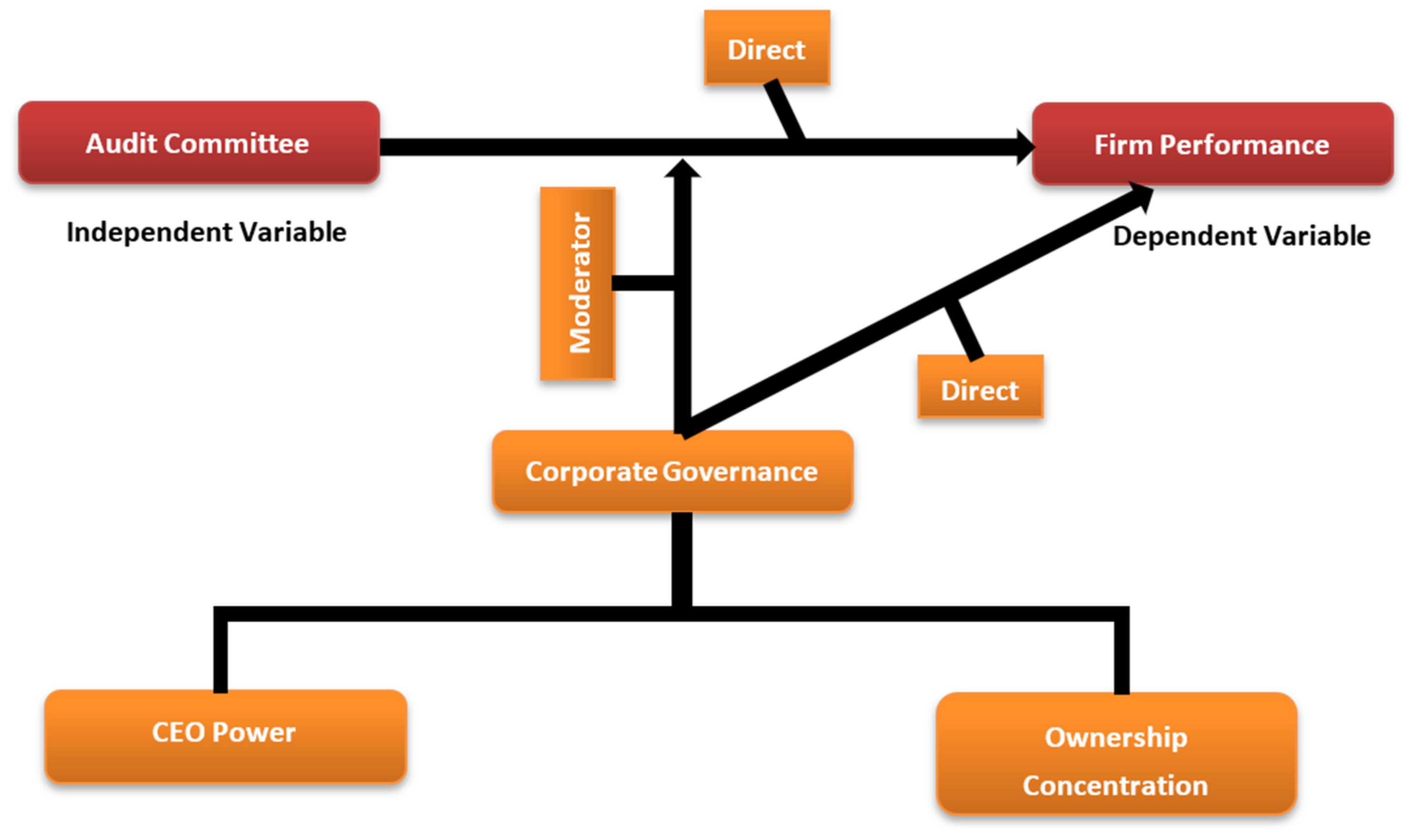

Sustainability Free Full Text Conceptualizing The Moderating Role Of Ceo Power And Ownership Concentration In The Relationship Between Audit Committee And Firm Performance Empirical Evidence From Pakistan Html

How Often Do Travel Nurses Get Audited Tns

How To Survive An Irs Audit Tax Time Irs Insurance Investments

4 Must Know Rules To Tax Free Money As A Travel Nurse Nomadicare

Tax Auditor Resume Samples Qwikresume

How To Survive A Tax Audit 14 Steps With Pictures Wikihow

Consultant App Design In 2022 Small Business Tax Business Tax Tax Time

How Often Do Travel Nurses Get Audited Tns